Texas is also one of the most popular candidates for the CPA exam in the United States. Texas certified public accountant, Texas fake certified public accountant. In order to help you choose the exam status that suits you, China Accounting Network School has compiled AICPA exam requirements specifically for Texas.

Driven by economic globalization, the accounting standards of various countries have become increasingly internationalized and unified. The US accounting standards have an important influence in the process of updating the international accounting standards. The U.S. CPA qualification is widely recognized in 64 countries and regions including China. This is an authoritative international accountant qualification; it is a powerful individual with knowledge and skills in international accounting, finance, and law. Proof; this is also a necessary knowledge preparation for business and business; it is also a powerful weapon to enhance professional functions and professional background. This qualification is an international authority, more representative of international accounting standards, and a symbol of the ability of practitioners.

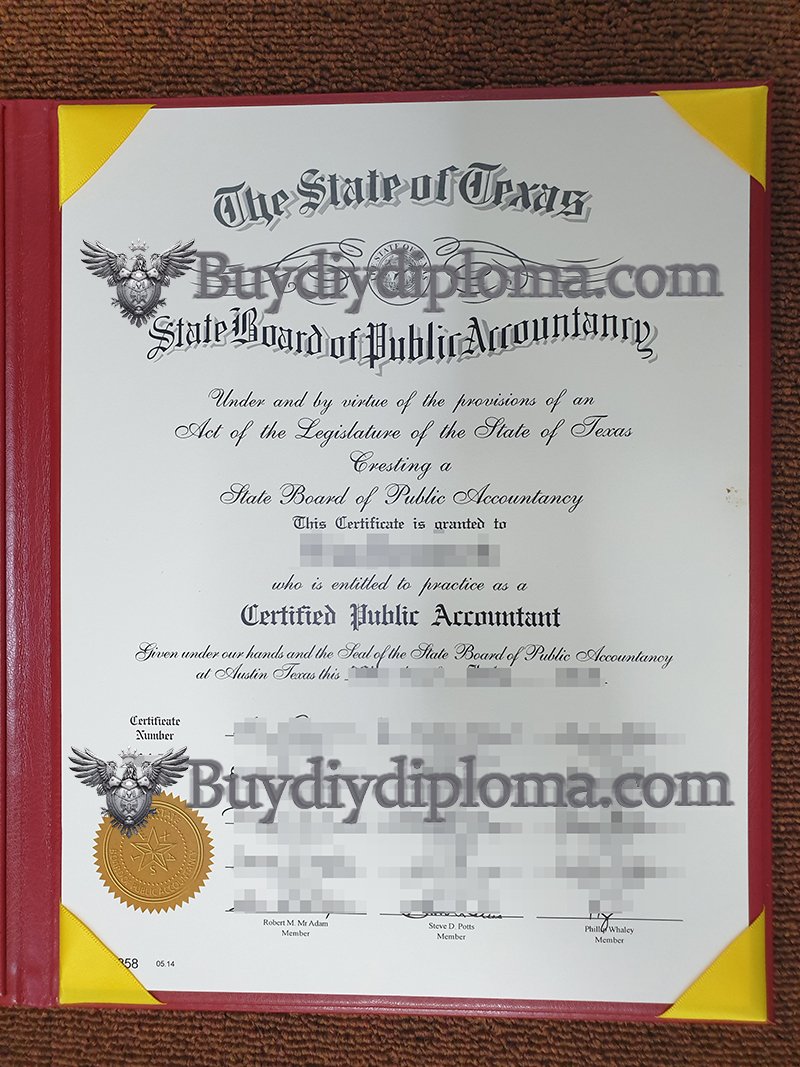

American certified public accountants have just landed in China, and their development prospects in China are generally optimistic. In recent years, how should I apply for the Texas CPA certificate? Where can I buy a Texas CPA certificate? Buying fake Texas CPA certificates, how to obtain fake Texas CPA certificates, as more and more Chinese companies are listed on the US capital market and more and more American companies enter China, this demand is particularly obvious. Data from the Chinese Institute of Certified Public Accountants show that they are eligible to obtain USCPA qualifications in China. The number is still very small. At present, there are approximately 250,000 talents who understand US GAAP and have US CPA qualifications. In the recruitment advertisements of the Big Four accounting firms and multinational companies, almost all recruitment financial positions require candidates to have the qualifications of a CPA in the United States. With the internationalization of accounting and the popularization of International Accounting Standards (IAS), Chinese companies listed overseas and well-known domestic companies or accounting firms in Europe and the United States are more likely to recruit American CPAs. The applicant is engaged in financial management.

All Samples

All Samples US Diplomas

US Diplomas CAD Diplomas

CAD Diplomas UK Diplomas

UK Diplomas AUS Diplomas

AUS Diplomas MAY Diplomas

MAY Diplomas GER Diplomas

GER Diplomas Other Diplomas

Other Diplomas