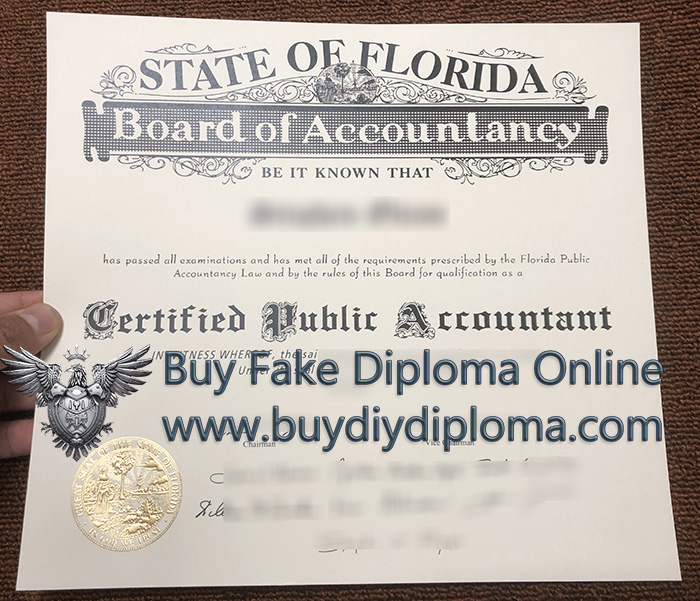

Florida CPA License – Florida CPA License Introduction. Order a Florida Certified Public Accountant (CPA) License. How to make a Florida CPA certificate? Buy a fake diploma online.

The Florida CPA license is a professional qualification certificate issued by the Florida Board of Accountancy, authorizing the holder to legally engage in auditing, taxation, consulting and other accounting-related services in the state. This license is highly recognized throughout the United States and meets the industry standards of the American Institute of Certified Public Accountants (AICPA). It is an important credential for the career development of accounting professionals. How to buy Fake California CPA certificate?

License Requirements

To obtain a Florida CPA license, applicants must meet the following conditions:

Education requirements: Complete at least 120 college credits (including 24 accounting credits and 24 business credits), usually a bachelor’s degree.

Uniform CPA Examination: Pass four exams established by the AICPA (Auditing and Attestation, Financial Accounting and Reporting, Regulation, Business Environment and Concepts).

Work Experience: Complete at least 1-2 years (specific regulations will be notified separately) of accounting-related work experience under the guidance of a certified public accountant (AICPA).

Professional ethics exam: Some states (including Florida) require passing the AICPA professional ethics exam.

Background check: Submit fingerprints and undergo a criminal background check.

License advantages

Qualifications: Can sign audit reports, handle tax matters on behalf of clients, and serve as corporate financial advisors.

Professional recognition: Improve employment competitiveness, suitable for accounting firms, corporate finance departments and government agencies.

Interstate practice: Through NASBA’s mutual recognition agreement (CPA Mobility), accounting services can be provided in other states.

Continuing education (CPE): The holder must complete 80 hours of continuing education every two years to maintain the license.

Florida CPA license is one of the gold standards in the accounting industry. It represents that the holder has professional ability, professional ethics and legal practice qualifications, which is an important guarantee for career development and high-paying positions.

All Samples

All Samples US Diplomas

US Diplomas CAD Diplomas

CAD Diplomas UK Diplomas

UK Diplomas AUS Diplomas

AUS Diplomas MAY Diplomas

MAY Diplomas GER Diplomas

GER Diplomas Other Diplomas

Other Diplomas